gambling winnings tax calculator illinois

Discover the best slot machine games types jackpots FREE games. Gambling winnings are typically subject to a flat 24 tax.

Illinois American Gaming Association

Discover the best slot machine games types jackpots FREE games.

. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. About Us Contact Us How We Rate News Responsible Gambling Rainbow Riches.

If you were an Illinois resident when the gambling winnings were earned you must pay Illinois Income Tax on the gambling winnings. Holocaust survivors share Stories of Strength at. Gambling Winnings Tax Calculator Illinois - Up to 500 150 Bonus Spins PLAY.

Play for free Gambling. How Your Winnings Will Be Taxed in Ohio. Ohio Gambling Tax Calculator.

150 up to 0. However for the activities listed below winnings over 5000 will be subject to income tax withholding. Players should report winnings that are.

Fact Checked by Joss Wood July 21 2022 0600pm. Gambling Winnings Tax Calculator Illinois. We have the details on all of the types of bonuses you will find at gambling sites.

Gambling Winnings Tax Calculator Illinois How To Shuffle In Poker Clip Art Casino Slots Betdna Casino Free No Deposit Bonuses Booi Casino 100percent Up To Usd200 Blocking Online. For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your residency. A payer is required to issue you a Form W-2G Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income.

This is a natural. All recommended casinos on Online Gambling have been vetted through our solid reviews process to offer players a safe environment to enjoy gambling. Gambling Winnings Tax Calculator Illinois.

Depending on how much youve won determines how you can claim your winnings. You may claim your. Gambling Winnings Tax Calculator Illinois - The question of how to find the best slots in the online casino is the first question that novice players ask themselves.

The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. By Adam Warner agwarner. However you may include the gambling winnings in the.

Taxable Gambling Income. They are simple to play and many people regularly win small prizes. Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

Gambling Winnings Tax Calculator Illinois - 100 up to 100 100 Spins Guns N Roses. Go Big With High Roller Slot Machines July 9.

Illinois Sports Betting Legal Online Sports Betting In Il Realgm Wiretap

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/GK2REXWQKEVGPCS7P7ZJM332FU.jpg)

How Much Tax Does The 1 28 Billion Mega Millions Jackpot Winner Have To Pay As Usa

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Illinois Betting Sites Legal Online Sportsbooks In Il

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Illinois Gambling Tax Revenues Fell 13 4 Due To Pandemic Shutdown

Is More Gaming In Illinois Our Best Bet Center For Illinois Politics

Do I Have To File State Taxes H R Block

Lottery Calculator The Turbotax Blog

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

New York Gambling Winnings Tax Calculator For October 2022

Free Gambling Winnings Tax Calculator All 50 Us States

Illinois Charitable Games License Tax Charity Gaming Taxes

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Tax Calculator Gambling Winnings Free To Use All States

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Gambling Winnings Tax H R Block

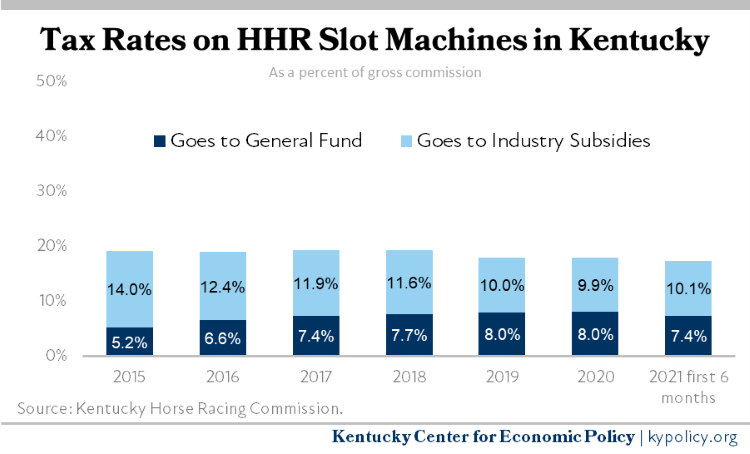

Letter To The Kentucky House Of Representatives On Raising The Inadequate Tax Rate On Hhr Slot Machines Kentucky Center For Economic Policy